Financial Advisors Illinois Can Be Fun For Anyone

Not known Facts About Financial Advisors Illinois

Table of ContentsThe Facts About Financial Advisors Illinois UncoveredFacts About Financial Advisors Illinois UncoveredAll About Financial Advisors IllinoisOur Financial Advisors Illinois PDFsHow Financial Advisors Illinois can Save You Time, Stress, and Money.About Financial Advisors Illinois

Edward Jones financial advisors appreciate the assistance and camaraderie of other monetary consultants in their area. Our economic experts are encouraged to offer and receive support from their peers.2024 Fortune 100 Best Firms to Job For, released April 2024, research by Great Places to Work, data since August 2023. Settlement offered making use of, not getting, the rating.

I'm trying to assess the benefits of employing a financial consultant, and can make use of some help examining the benefits and drawbacks. Below's a recap of the consultant and his method: - He is a CFP and fiduciary with LPL monetary - Charging $3k level cost each year - 0.2475% quarterly costs offered my portfolio bracket of $250K-$500K (so 1% annual) - From speaking with him, his strategy is to utilize a "personalized portfolio" (which I believe is direct indexing) to tailor the portfolio based upon my requirements, like state of residency, risk/reward preferences, etc - He also pointed out tax obligation loss harvesting (TLH) as a benefit that he offers He sent me the adhering to resources to information the advantages of collaborating with an advisor: 1.

I'm not planning to squander capital gains annually, so uncertain just how much TLH will actually benefit me 2. I'm an unconvinced of the TLH advantages over time as a result of "decay" (as I lack old investments that can be marketed at a loss) 3. I'll be "locked in" to the expert, since a "tailored portfolio" will spread my profile over lots of supplies, which will certainly be tough to handle if I ever before wish to not have a consultant 4.

The Single Strategy To Use For Financial Advisors Illinois

:max_bytes(150000):strip_icc()/ways-financial-advisors-charge-fees-2388441_V1-b9356000e6194c3ebced21e583eb23f0.jpg)

This includes subjects such as retirement planning, financial investment strategies, tax obligation planning, and much more. CFP specialists are required to pass a comprehensive test, contend least 3 years of specialist experience, and adhere to strict ethical requirements. This means that when you work with a CFP expert, you can trust that you're functioning with someone educated and who's mosting likely to follow a fiduciary requirement of advice and always show your finest rate of interests in mind (something that not all experts need to follow).

Among the biggest benefits of functioning with a CFP specialist is the customized guidance you'll receive. A good financial organizer will certainly put in the time to recognize your one-of-a-kind financial scenario, goals, and risk tolerance, and develop a personalized plan that's tailored to your needs. This degree of customized attention just can not be matched by a one-size-fits-all budgeting application or robo-advisor.

Not just that, yet any type of guidance a CFP expert gives you is called for to be performed in a fiduciary capability. That suggests suggestions is constantly given up your best passion, which isn't constantly a need of other economic consultants. When you work with a CFP expert, you'll have someone to hold you answerable and give recurring assistance as you function in the direction of your monetary goals.

Some Known Questions About Financial Advisors Illinois.

Among the simplest methods to locate a CFP expert near you or that may be a great suitable for you is to check out where you can look for a CFP expert to fit your requirements. When picking a CFP specialist, it is necessary to consider factors such as their experience, certifications, and the solutions they use.

One more benefit of working with a CFP specialist is the personalized focus you'll get. Unlike a budgeting application or robo-advisor, a CFP professional will certainly make the effort to understand your distinct monetary situation and establish a personalized strategy that's tailored to your demands. This degree of personalized attention can help you attain your financial goals much more efficiently.

Your CFP can offer you with support and support as you browse these obstacles and assist you remain on track towards your objectives. Functioning with a CFP specialist can additionally raise your responsibility when it pertains to your finances. When you have someone to address to and a strategy in place, you may be extra determined to make positive economic modifications and stick to your plan.

Get This Report about Financial Advisors Illinois

They will likely have a CFP designation on their signature or internet site. Remember, not all CFP's are equivalent and some might work in very specialized locations or with specific niche's of customers. Think of the details economic problems you require assist with and seek a CFP expert who concentrates on those areas.

In today's landscape of monetary planning & wide range management, it's remarkably challenging for consumers to find an expert or organizer that's an excellent fit for their needs and who will constantly supply them suggestions as a fiduciary (i.e. in their finest interests in any way times). Numerous riches management companies will claim to 'do right by their clients' or 'use great guidance', when actually their solutions are restricted just to marketing financial investments to their customers with potentially big payments to those consultants.

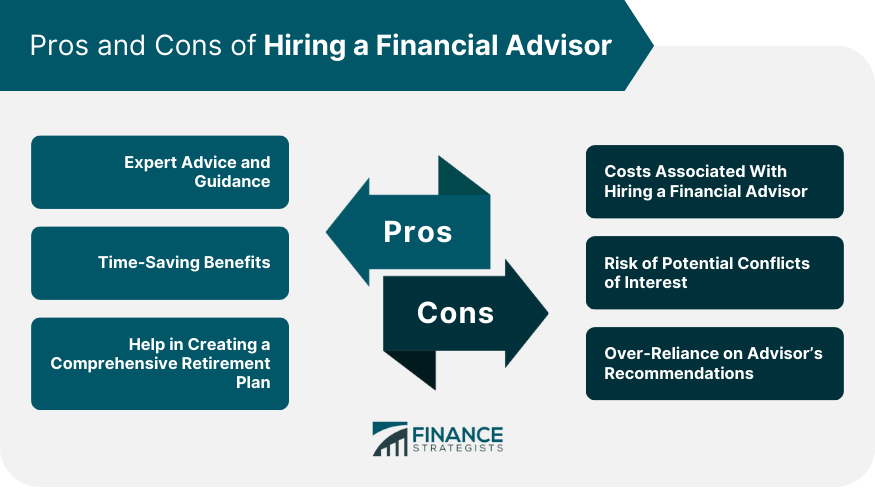

Having an economic consultant can be unbelievably valuable for lots of individuals, yet it is necessary to weigh the pros and disadvantages prior to deciding. In this write-up, we will explore the advantages and drawbacks of functioning with a financial consultant to aid you decide if it's the best relocation for you.

Cons of Functioning with a Monetary Expert:: One of the most significant drawbacks of collaborating with an economic expert is the cost. Numerous economic consultants bill fees based on a percentage of possessions under administration, which can be rather high, particularly if you have a big portfolio.: Some economic experts might have disputes of rate of interest, such as obtaining commissions for marketing specific product and services.

Our Financial Advisors Illinois Diaries

To conclude, functioning with a monetary advisor can be a wonderful way to accomplish your monetary goals, however it's important to evaluate the advantages and disadvantages very carefully prior to deciding - Visit Your URL Financial Advisors Illinois. The cost and the threat of conflicts of passion are the primary downsides of working with an economic advisor

It's essential to do your research study and click here now discover an economic consultant you rely on before entrusting them with your financial future. For extra inquiries - don't think twice to Message me straight!.

It can be simple to drop into the catch of thinking that you don't need assistance from any person when it comes to your financial resources., you shouldn't have that worry.

Getting The Financial Advisors Illinois To Work

In this overview, we will discuss exactly what an economic expert does, when you need to employ a monetary consultant, and the benefits of working with one. The economic expert interpretation is an individual you hire to assist you with financial administration. They can aid with tax obligations, increasing return on your investments, intending for the future, and more.

Once they recognize what economic goals you have, they will create a method to assist you conserve cash and reach those objectives (Financial Advisors Illinois). If you are intending on investing a good piece of cash on a huge event or acquisition (such as a wedding, residence, cars and truck, etc), financial advisors will consider your current financial scenario as well as market predictions and the economy to encourage you on the finest means to save money for the sort of event or purchase you desire

A financial consultant can tell investigate this site you that as well as all the steps that you require to take in your journey to accomplish those objectives. Financial advisors create customized strategies based on how much cash you have and what you are aiming in the direction of.